Decoding the Rise, Rise & Rise of Gold

Since 407 B.C., a tough and noble asset named gold has got going when the going in markets gets tough. Usually, it takes silver along.

FINANCEBEHAVIORAL FINANCEBEHAVIORAL ECONOMICSECONOMICSINVESTMENTSAFE HAVEN

Indrajeet Yadav

6/15/20194 min read

“Get gold humanely if you can, but at all hazards, get gold.”

King Ferdinand of Spain, 1511 A.D.

Gold: A Timeless Troubleshooter

Athens was an endangered city-state in 407 B.C. Sparta had just grabbed her silver mines. Unable to mint silver coins needed desperately to finance the war, the Athenians debased their currency – bronze coins with silver plating and traces of gold. Hopelessly cornered, they assigned the coin a face value way above its intrinsic one!

Result: World’s first recorded grade inflation. Why? Because the coins lost their purchasing power.

Gold and silver prices shot through the roof.

Boer Wars were Fought for Control over Gold Mines

Fast forward to May 2019.

Two events, in particular, turned on the global political temperatures while planet Earth reeled under a scorching heat wave. It never gets warm, it swelters – literally and figuratively. Global Warning with Global Warming!

President Trump announced tariff hikes on $200 billion worth Chinese imports from 10% to 25%. Plus, the U.S. imposed severe restrictions on exports of information and communication technology (ICT) devices to China.

Middle East was simmering since the Trump administration re-imposed sanctions on Iran in 2018. Hostilities flared up in May 2019 when oil tankers in the Gulf of Oman were damaged, allegedly at Iran’s behest.

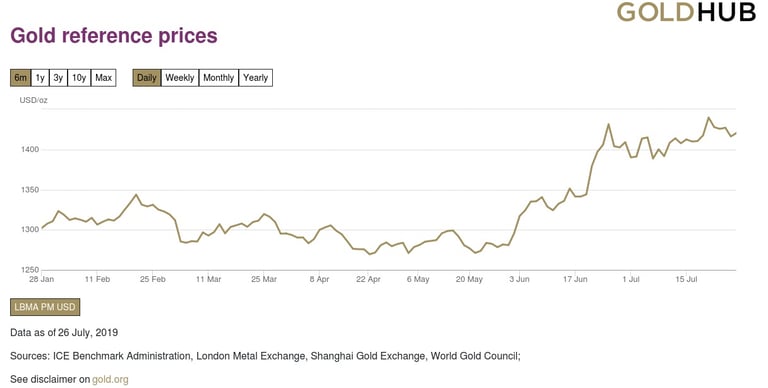

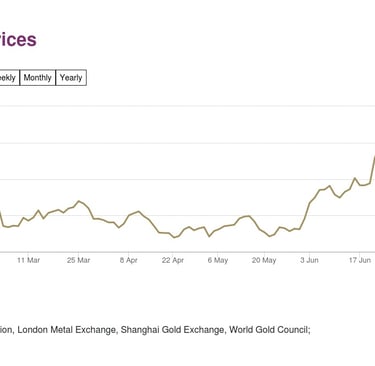

Spiralling Gold Prices since end-May 2019

Gold prices skyrocketed around end-May 2019.

Sentiment: The Real Market Mover

Point is, gold soars whenever uncertainty grips markets. Remember how it spiked during the 2008 global financial meltdown? Gold picks up when returns from stocks, bonds, or real estate fall. Or are expected to fall.

Not just markets. People trust gold for security against all varieties of instability – inflation, deflation, currency devaluation, political crises . . .

But, the correlation between inflation and gold prices is weak. This brings us to the omnipotent agent of price fluctuations – human sentiment. It all starts in the mind. Inflation triggers fear. And it is the sentiment of fear that makes investors flock to gold!

Markets operate on sentiment or expectation. This is basic human temperament – we all want to own assets whose price is expected to rise in the future. Note the word: expected.

So much so that if a certain event is expected to occur, prices swing regardless of whether the event actually occurs. The forecast of a drought, for example, will immediately spike the food grain prices. Even if the forecast proves wrong later, prices will rise at present. Prices may drop in future if it rains normally.

And when one asset looks like a loser, we invest in the potential winner – one that promises to gain value in the future.

Why are Gold Prices Rising

U.S.-China Trade Tensions and Possible No-deal BREXIT: IMF lowered the global economic growth forecast from 3.3% in April 2019 to 3.2% in July citing U.S.-China trade tensions and a possible no-deal BREXIT. Both lower the trade opportunities, diminishing market prospects. Any uncertainty favours gold.

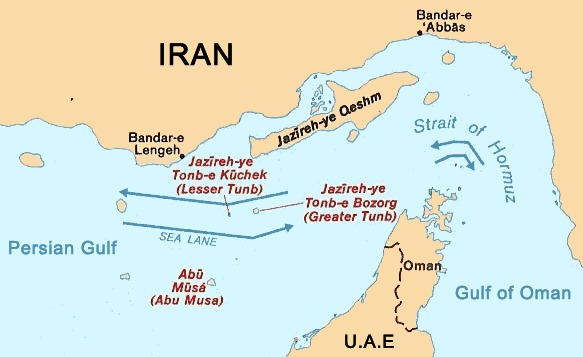

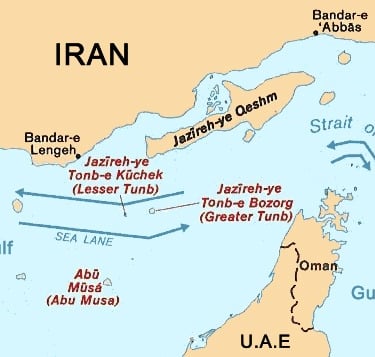

Strait of Hormuz is a Strategic Choke Point for Oil Transportation

U.S.-Iran Tensions in Middle East: Iran can strike oil tankers sailing in the Strait of Hormuz at will, directly or through proxies. A staggering 21% of oil consumed around the world passes through here. As does a third of the globe’s liquefied natural gas.

A Hormuz blockade will apply serious brakes to the wheels of the energy-hungry global economy. Instability spurs rise of gold.

Possible Rate Cuts by Central Banks: Central banks cut interest rates to make borrowing less expensive and expand the money supply. This encourages people to spend and businesses to borrow, both of which create demand for goods and services.

And this demand stimulates production and brings the economy back on track. Or is supposed to. Without people’s faith in the economy, such stimulation falls flat. What is more, the currency depreciates because over-supply causes loss of value. In this case, the currency loses purchasing power.

European Central Bank (ECB) belied expectations and maintained unchanged rates. If the Federal Reserve lowers rates in its end-July, 2019 meeting, the dollar will weaken and propel gold upwards.

Gold and dollar move in the opposite directions because:

Falling dollar cuts its attractiveness for investors who shift to gold.

International gold is denominated in dollars. A falling dollar, therefore, pushes up gold.

A weak dollar means stronger other currencies. With their purchasing power reinforced, they start purchasing commodities, gold included.

Central Banks’ Gold Purchase: Central banks around the globe are buying gold to diversify reserves. Even otherwise, central banks are the world’s topmost gold investors. Indian, Chinese, Kazakh, Russian, Polish, and Hungarian central banks are all shoring up their gold reserves.

Underinvested Portfolio Asset: Fund managers will suddenly discover that gold is not as dead an asset as they thought. The enlightenment will further bolster demand.

Finally

True blue never stains. And, true gold never rusts. Rather, true gold glitters more as everything else loses sheen. Silver is an exception though. Know now why we call them noble?

Like gold, we believe in being 24-carat true in our commitments to clients. Get in touch with us at indrajeety1981@gmail.com or +91-9822052945 for original and interesting content on a wide range of topics.

#behavioralfinance #goldprices #silverprices #internationalgoldprices #goldpricesindia #whygoldanddollarpricesmoveinoppositedirections #monetarypolicyandgoldprices #interestratesandgoldprices #federalreserve #europeancentralbank #ecb #stockmarketandgoldprices #speculationandgoldprices #roleofmarketsentimentonprices #GoldRush #Investment #MarketTrends #FinancialGrowth #SafeHaven #EconomicInsights